Housing Affordability Myths: What Data Really Shows: Part 2

Editor's Note: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Regent University, its faculty, administration, or affiliates.

In my first essay about affordability, I confirmed that, generally speaking, housing prices have increased since 1970. I also presented data offering some explanations: home quality is better, houses are larger, and fewer people live in each one. Other factors to consider include the fact that people are getting married later and, therefore, the demand for housing on a per capita basis is higher than in previous generations. Many twenty-somethings in past generations, who were one household, are now two. But none of what was discussed in part one explains the huge drop-off in new-home construction over the past 15 years.

Quality improvements are a long-term trend driving prices up, but zoning regulations, the building permit processes, and environmental regulations restrict where housing can be built and how long it takes.

One policy that would help in some of the most expensive areas would be the removal of rent controls. New York, California, and Washington D.C. are among the most expensive places in the country to live, and they all have rent control, which effectively disincentivizes the building of new housing. Also, rent control distorts the market for the remaining housing in ways that tend to favor the wealthy and well-connected.

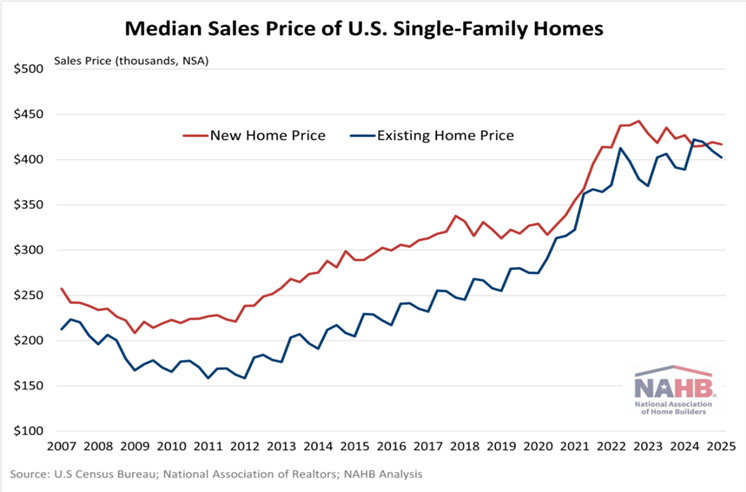

Many of these policies have been in place for some time, and while their effects are real and significant, they do not explain recent developments. As the graph below shows, the U.S. has experienced the unusual condition of new-home and existing-home prices converging during most of the post-COVID period:

Even during the “Great Recession” from 2007-2009, which was sparked by a home-mortgage crisis, the gap between new- and existing-home prices persisted, but not so over the past five years.

There are several contributing factors to all of this.

One is that we have been in a high-interest environment due to inflation and competition from significant increases in government borrowing. Housing demand is very elastic with respect to interest rates. A small change in rates, which translates to thousands of dollars over the life of a mortgage, can change demand quite a bit. Prices peaked in 2021 and have fallen since, reflecting low demand. The Federal Reserve recently announced a .25% rate cut, and housing experts are expecting a positive shift in demand as a result. Time will tell if that happens, how large the effect is, and how long it lasts, but theory suggests there will be some positive impact.

Another factor that can lock up an economy is uncertainty in the future. The spike immediately following COVID was something of a catch-up effect, but then we had two significant presidential changes, with numerous changes to tax policy and other related policies. Builders and borrowers do not want to make long-term commitments in environments of uncertainty because it increases risk.

The recent higher-than-expected economic growth numbers may be clarifying to some, as we begin 2026. We saw this even before the GDP data was released, as real estate experts feel the next five years will be better but “still constrained.”[2] Whether or not that happens really comes down to sustainable economic growth.

Another aspect of this market is expectations. Several articles conclude that first-time home buyers are looking for more features, amenities, and considerations than ever before. “Eighty percent or more of home buyers in NAHB’s (National Association of Home Builders) survey rate the following property amenities as ‘essential’ or ‘desirable’:

- Laundry room

- Patio

- Energy Star windows

- Exterior lighting

- Ceiling fan

- Garage storage

- Front porch

- Hardwood flooring

- Full bath on the main level

- Energy Star appliances

- Walk-in pantry

- Landscaping

- Table space in the kitchen”[3]

Think about that 1970 house from the first article: Picture “The Brady Bunch” home, which is still standing, with six kids sharing two bedrooms as members of an established professional family. (“Mr. Brady” was an architect, and the family had a maid, “Alice”.) They did not have most of the things listed above. Some were not available, but many were considered luxuries. Now, those items are expected from first-time home buyers, and according to NAAHB, “[O]ver the last decade, the following home features have posted the most significant growth among home buyers…”:

- Security cameras

- Wired home security system

- Programmable thermostat

- Multi-zone HVAC system

- Energy management system

- Video doorbell[4]

None of these even existed in 1970.

The housing market is distorted. The government influences it in many ways, which is reflected in pricing. So, if Americans want a more vibrant and responsive housing market in the long run, we need to eliminate as much of that as we can. Recent economic conditions have made some significant impact on short-term fluctuations, exaggerating the current situation even more.

The solution is more houses, which means more building, which means making it easier to build. It also means less government regulation in housing and zoning. Modern housing is better in many ways than ever before, and consumers, even first-timers, have elevated expectations. When they say they can’t afford a house like their parents did, what they really mean is they can’t afford the house that meets this long list of “must-haves.”

If someone wants to buy a 1970 house, they can do so for about the same relative price. But so much more is available, and many want more, but it costs money. Garages, front porches, security systems, and walk-in pantries are not free.

[1] https://eyeonhousing.org/2025/05/prices-for-new-homes-continue-to-drop-as-existing-rises/

[2] https://realestate.usnews.com/real-estate/housing-market-index/articles/housing-market-predictions-for-the-next-5-years

[3] https://www.nar.realtor/magazine/real-estate-news/sales-marketing/13-features-new-home-buyers-say-are-essential-desirable

[4] https://www.nar.realtor/magazine/real-estate-news/sales-marketing/13-features-new-home-buyers-say-are-essential-desirable